Small enterprises and mobile businesses can now accept digital card payments in-store, remotely or on-the-go using their connected mobile devices, following the launch of Virtual Card Service’s virtual Point of Sale (vPOS) – South Africa’s first virtual payment solution.

Powered by MasterCard’s MasterPass digital payments platform, the vPOS provides a safe, convenient and easy way for merchants to be paid using their own connected mobile phone as a point of sale (POS) device, while consumers can pay for goods and services using MasterPass, a digital wallet.

“We designed the vPOS to meet the needs of merchants who do business ‘on the move’ and need to accept card payments wherever they are conducting business - be that at someone’s house or selling products at weekend markets or roadshows,” says Wouter Uitzinger, chief operating officer at VCS. “We see enormous potential for the solution in South Africa, especially with the large number of informal traders, and the growing population of smartphone users.”

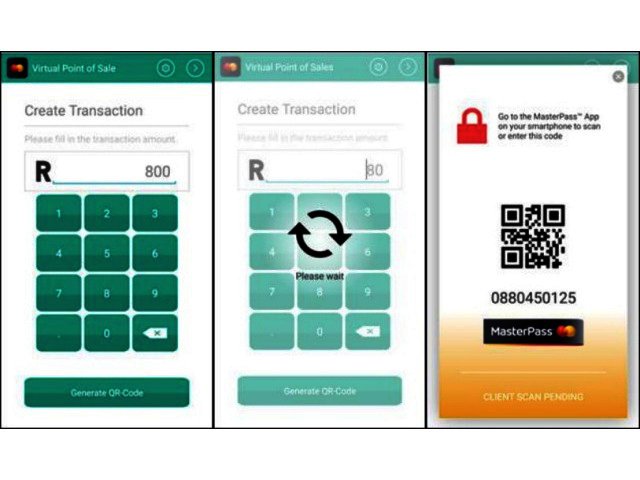

To sign up for a vPOS, merchants simply apply for an affordable merchant facility directly from Virtual Card Service, after which they download the vPOS app from their Android or Apple store and authenticate their credentials. To accept payment, they enter the transaction amount on the app's keypad and generate a MasterPass Quick Response (QR) code that is displayed on their own device.

Consumers need to download the MasterPass app from their app store, register, and load their credit, debit or cheque cards from any bank into the digital wallet. To pay, they simply open the MasterPass app on their mobile device and scan the QR code. They select the card they wish to use, enter their bank PIN number on their own device, and the transaction is complete.

“Mobile technologies have emerged as a powerful tool for shop owners and mobile businesses to accept digital payments,” says Anton van der Merwe, head of Market Development for MasterCard, South Africa. “As a fast, easy and inexpensive POS device that can be used literally anywhere, the vPOS has the potential to open up new revenue channels for merchants and enable them to meet the demands of today’s connected shopper.”

With the vPOS, merchants can increase revenues from accepting digital card payments, and reduce their exposure to the risks and costs of managing cash. Payment is immediate and is guaranteed, meaning that merchants no longer need to wait for Electronic Fund Transfers or cheques to clear. VCS also reconciles payment and Value Added Tax to offer even more efficiency and time-savings to the merchant and is more affordable than traditional POS or mobile POS devices.

For consumers, MasterPass offers a simple, convenient, trusted digital platform that provides a fast, safe shopping experience. It enables consumers to pay for the things they want with the security they demand, using any connected device.

Unlike many other similar solutions, each MasterPass transaction is classified as an Authenticated Mobile Transaction by South African Banks, ensuring that consumers enjoy the highest protection from fraudsters.