Since PSD₂ came into effect in January 2018, the world’s traditional banks have been irrevocably impacted. By opening up access to consumers’ financial data, previously owned exclusively by the banks, the new regulation allows fintech start-ups to legally access this data, once consumers have opted-in, and offer banking-type services – without needing a bank to do so. This has allowed more players to enter the market under regulatory supervision.

The first of its kind in Africa to consolidate this opportunity into a community-built financial ecosystem is South Africa’s Bettr. It officially launched in Alpha today at MoneyConf 2018, the most prestigious tech event attended by the likes of Number26, Monzo and investors Peter Thiel Valar Ventures, South African VC Roelof Botha Sequoia and Accel Partners. Bettr was one of only two South African fintechs to be invited to attend and pitch to heavy-weight investors at the event.

Onboarding personalised products

Entering through the Bettr app, users gain access to a financial graph that connects them to a bounty of financial products and services such as car or home purchases, or insurance. RainFin, a P2P lending marketplace, Collab, a financial wellness initiative for debt distressed employees, and The City of Cape Town’s Youth Empowerment Programme have already been onboarded during Bettr’s Alpha phase. During Beta, the fintech plans to address South Africa’s bloated student debt, bring financial wellness to employers and enable affordable mobility through the e.g. ownership of a vehicle or travel.

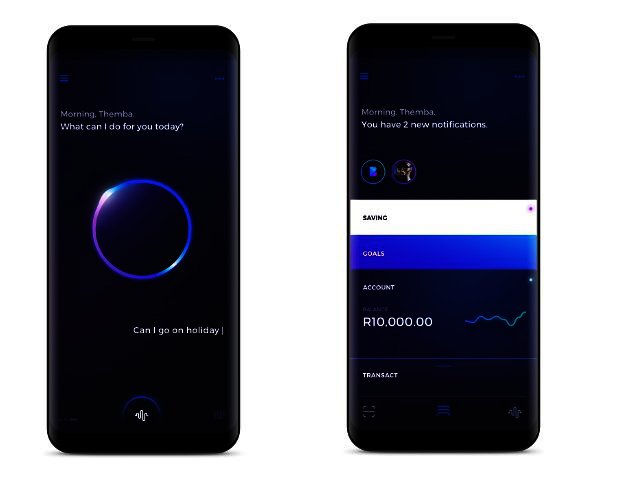

PSD₂ also allows Bettr to give financial recommendations to opt-in users. For instance, if they wish to travel in December, machine-learning algorithms baked into the back-end respond in real-time suggest a savings plan based on the users’ profile and financial behaviour. If travelling to another country, it also converts a user’s budget to afford daily expenses.

Customer-centricity central to fintech product build

Built around and with users’ input – Bettr crowd-sourced intelligence from over 4000 consumers – the platform is completely customer-centric. The outcome is a sophisticated, responsive experience that gives users what they need, on demand or at the tap of a button.

Founders Tobie van Zyl and Andrzej Stempowski say, “Our vision is to connect the world to the financial graph. Based on Open Banking principles, it makes finance accessible, transparent and is integrated to how people can become more by using their money.”

No need for old-school rules

Bettr’s financial graph has no need for physical infrastructure – a relic of a past banking system – and gives users control of their money while lowering the costs of complementary financial services. Once inside the Bettr app users create their personal financial DNA which optimises their creditworthiness and affordability. Financial, and other types of institutions simultaneously connect to the Graph API (Application programming interface) on a permission bases to offer and originate products and services that users say they want.

Fintech takes on GAFA

While the Big Four, known as GAFA (Google, Amazon, Facebook and Apple) has made strides to enter the banking arena given their access to personal data - largely with P2P payments and mobile wallets - fintechs like Bettr have the upper hand, thanks to the introduction of regulation that has eradicated the firm grip that traditional banks have had over customer data, opening up the financial ecosystem to give consumers more choice and control of their money.

Bettr is now in Alpha and plans to phase in to Beta in during the course of the next few months.. After testing with its community on UX and CX, it plans to go live in Q4 of 2018.

Visit www.bettr.finance and follow on @Bettr.finance #moneyconf2018 #bettr2018