Many South African SMEs continue to use inflexible, expensive payment solutions from large financial institutions because they are not aware of new-age online payment offerings that offer them lower costs and higher levels of business automation.

That’s the key finding of market research conducted by Curiosity Box on behalf of payments specialist, Sage Pay. The research reveals that most SMEs are not thinking about the opportunity of streamlining their payment environment. As a result, they are losing out on significant time and cost savings, says Managing Director of Sage Pay, Charles Pittaway.

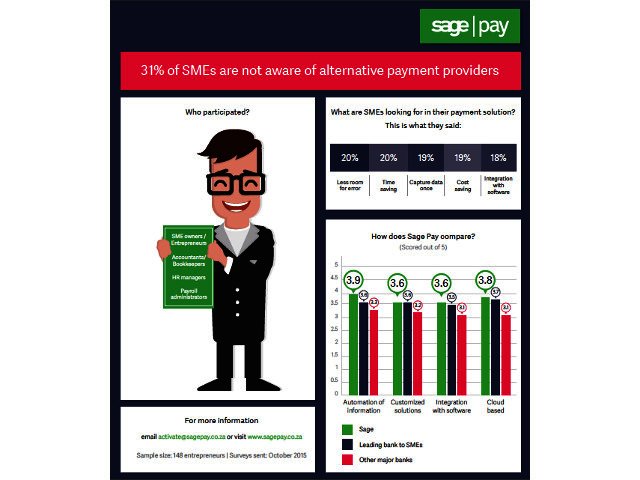

The study shows that 31% of SMEs are not aware that there are alternative payment providers. The result, for many companies, is that they are frustrated by high payment costs, low levels of automation (making payments time-consuming and prone to human error), and a lack of customisation in their payments solutions.

Says Pittaway: “A choice of payment providers remains a passive decision because most accountants and owners at small businesses think that a bank is the natural choice of a payment partner. And since they perceive all banks to be much the same, they’ll simply use the institution that handles most of their banking needs already.

The research finds that SMEs find supplier payments to be a pain point, especially when they have a large amount of payments to make each month. Higher levels of variability (compared to salary payments) means that there are more opportunities for mistakes to creep into supplier payments.

Typical errors include mistakes on invoices (Amounts, PO numbers), typing errors when processing payments, and late invoicing - problems that can mostly be dealt with in a more automated process, says Pittaway. Yet bulk payments to a diverse range of suppliers, employees, statutory bodies and creditors remain an inflexible, manual exercise for many SMEs.

For many smaller companies, Internet banking and batch file upload solutions from the major banks are expensive and cumbersome for their needs. They sometimes are difficult to use and require the installation of specialised software, export and import of data, and manual reconciliations.

For these reasons, SMEs should look to alternatives that make it safe and simple to capture details for recurring and once-off payments directly on one system which is accessible anywhere at any time, says Pittaway. Such services offer business owners a simple and easy-to-understand pricing structure without any hidden charges, and should integrate with payroll and accounting software to eliminate the need to recapture payment data.