IDC - PC market struggles ahead of Windows 8 launch

By Hanleigh Daniels 12 October 2012 | Categories: news

During Q3 2012, the worldwide PC market decreased significantly as shipments dropped by 8.6% from the same period last year. This is according to market research firm IDC’s (International Data Corporation’s) worldwide quarterly PC Tracker service.

The analytics firm expected a quiet quarter as channels focused on clearing out Windows 7 inventory in order to make space for Windows 8 stock. This channel clearing, coupled with continued pressure from other products, including smartphones and tablets, as well as uncertainty over the impact of Windows 8 and the economic outlook, contributed to decreased shipments.

Jay Chou, senior research analyst at IDC’s worldwide PC tracker service, stated that PCs are going through a severe slump at the moment. Chou said that the PC industry had already weathered a tough Q2 2012, and now Q3 2012 turned out to be even worse.

A weak global economy, as well as questions about PC market saturation and delayed replacement cycles, are certainly factors in this decline, but Chou added that the hard question of what is the “it product” for PCs remains unanswered. While ultrabook prices have come down a little, there are still some significant challenges that will greet Windows 8 in the next quarter.

Vendor highlights

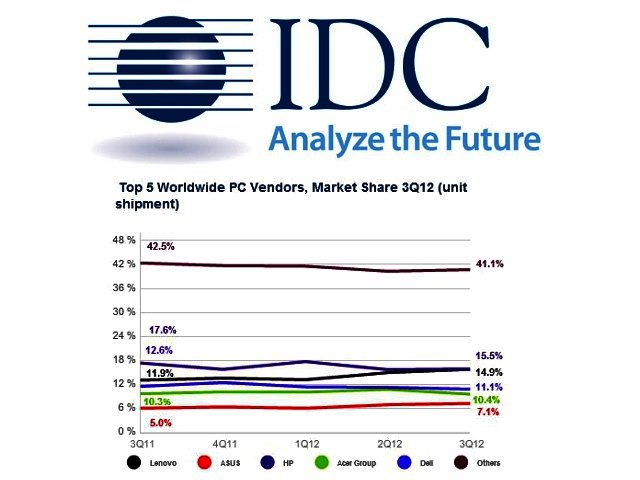

HP saw shipments reduced by more than 16% compared to Q3 2011 and only narrowly managed to hold onto the top vendor spot. According to IDC, distractions caused by its structural reorganisation, challenges in integrating its enterprise acquisitions, as well as an unclear strategy to regain its course remained key obstacles for the company.

Despite slowing growth in Asia, Lenovo continued to register the highest yearly growth amongst all of the top PC vendors. The firm built upon its channel partnerships and also acquired key OEMs in markets outside of China with varying degrees of success. This assisted the Chinese firm in maintaining a Top 5 position Stateside and gain a couple points of market share globally, to nearly tie HP for the lead in terms of global PC shipments.

Dell faced a tough quarter as the vendor saw its market share decline in all markets, ending the quarter with a 14% decline. The Asia/Pacific regional market became the second biggest PC market for Dell right behind its US home turf.

After the market for low-priced notebooks diminished somewhat, the Acer Group faced an uphill climb to get back into positive market growth mode. Q3 2012 produced shipments of a sequential decline for Acer, along with disappointing notebook volumes. The IDC did state, however, that Acer’s aggressive ultrabook- and Windows 8 tablet strategy could help the firm regain its fortunes if Windows 8 finds solid consumer acceptance.

“We expected a weak PC market in the lead up to Windows 8 release in the fourth quarter. While the industry has been focused on shaving excess inventory and preparing to launch a new generation of products, consumers have been looking at alternative devices like tablets. In addition, businesses have slowed their refresh cycle as they remain concerned about the broad economic outlook, amid a busy political season,” said David Daoud, research director of Personal Computing at IDC.

“Nevertheless, as vendors line up innovative new products and designs, consumers are likely to respond positively during the tail-end of Q42012, and that means a potential return to positive growth at the end of this year.”

In related news, the IDC also recently raised its tablet shipment forecast for 2012 to 117.1 million unit, which is a more optimistic change from the company’s previous forecast of 107.4 million tablets for this year. In addition, the IDC also increased its 2013 forecast shipment tally from 142.8 million to 165.9 million units and by 2016 the company expects that global tablet shipments will reach 261.4 million devices.

Most Read Articles

Have Your Say

What new tech or developments are you most anticipating this year?