Nedbank enhances digital banking offerings

By Ryan Noik 2 September 2021 | Categories: news

News sponsored by Republic of Gamers ROG Zephyrus M16

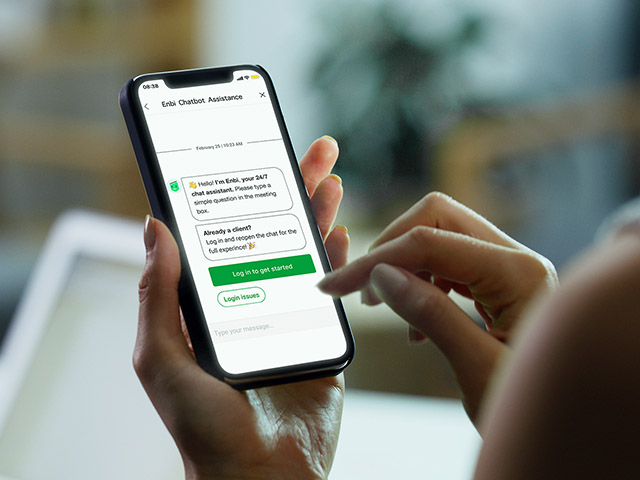

In news that will surely be of interest to Nedbank customers, this week the bank announced three new enhancements to its digital banking offering. These include cardless withdrawals, simplified cellphone banking (USSD) registration and a conversational chatbot assistant called Enbi.

Nedbank’s Ravikumaran Govender explained that while Covid-19 and the national lockdowns sharpened the world’s focus on the importance and value of rapid digitisation, the bank has been investing significant resources into building its digital banking experience long before the pandemic. This foundation is now enabling the financial institution to respond quickly to the “need for affordable, time-saving and personalised digital banking solutions, with a genuine human touch,” he elaborated.

“Our digital journey is, and always has been, undertaken with the targeted destination to offer clients an easy to use, highly engaging and helpful digital banking experience, one that ensures seamless, cost-effective and convenient banking across all our digital channels,” he noted.

Govender elaborated that Enbi offers users an easy to use way of getting day-to-day tasks done in a timeous manner, as well as allowing customers a more natural way of engaging with Nedbank.

“One of the challenges with banking apps is that it can take time to find the various features that the customer is able to use. Enbi helps by understanding what the customer is looking to achieve and either giving them the information or guiding the customer to the right function,’ says Govender.

More specifically, Enbi navigates users to key features in the Money app and when doing Online Banking and has useful buttons and quick replies so they can quickly and easily achieve their task. Furthermore, the chatbot guides users in how to perform certain tasks, like how to reverse a debit order or find their nearest branch.

Govender explained that its customers had enthusiastically adopted the Live Agent Chat functionality that was implemented two years ago. Enbi builds on that to further enhance the ability of customers to engage with the financial institution by offering a human-like conversational user experience.

While Enbi is a notable development, it is not the only one in the pipeline. The bank is set to unveil a number of other enhancements to its digital banking offering, including enhanced cellphone banking (*120*001#) and an innovative cardless withdrawal solution on the Nedbank Money app, Nedbank Online Banking, Cellphone Banking and MobiMoney platforms.

The cardless withdrawal facility is aimed at making it quick and easy for Nedbank clients to send money to recipients, even if they are not Nedbank clients. Recipients can withdraw the cash from any Nedbank ATM or at selected retail stores, using a secure voucher number and one-time password. The bank has already partnered with Shoprite, Checkers, Usave and OK stores, and will pledged that it will continue to grow its footprint across the country.

According to Govender, these enhancements align with Nedbank’s ongoing commitment to ensuring that clients who prefer to use convenient and cost-effective cellphone banking can now also enjoy other benefits that this popular platform offers. To this end, Nedbank is implementing a secure and simplified process for registering for cellphone banking services – by dialing *120*001#

“Until now, clients had to use their Nedbank profile and PIN credentials to register, which meant that they first had to visit a branch to create a profile and then had to remember a 10-digit profile number and PIN…we recognised the need to bring in more convenience and a simpler experience for customers,” achnowledged Govender.

Going forward, clients can register for cellphone banking using their Nedbank card details or following the traditional profile and PIN process. Either way, clients register only once, and then receive a five-digit cellphone banking PIN, which is all they need to access this convenient, feature-rich mobile banking platform.

“Our cellphone banking service gives Nedbank clients access to more than 40 menu-driven banking actions, including transfers, card and debit order management, notice of withdrawals, balance checks and value-added services like airtime and utility purchases. And because it costs only R1 per minute in airtime, it is an affordable and convenient way to get all your banking done anytime, anywhere,” he concluded.

Most Read Articles

Have Your Say

What new tech or developments are you most anticipating this year?