What does the future of Android-based POS terminals look like?

By Industry Contributor 12 December 2023 | Categories: news

By Derek Keats, MD, ExiPay Africa

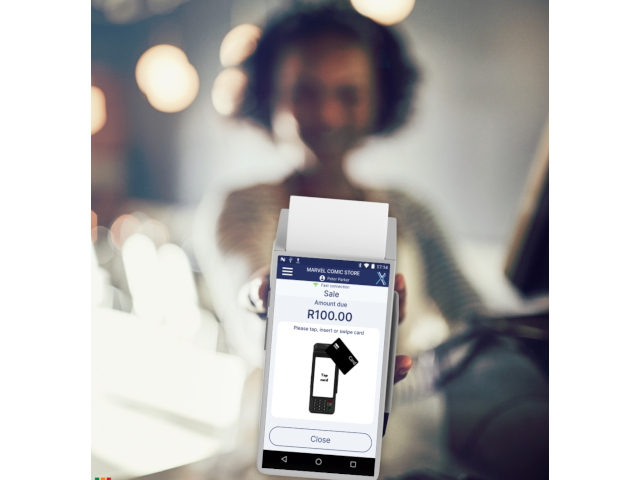

Most of us probably don’t spend that much time thinking about what operating systems are installed on the point-of-sale (POS) terminals, also known as card machines, that allow us to buy gifts at a boutique, lunch at a food market, or even our weekly groceries. Dig a little deeper, however, and you’ll find that a growing number of POS terminals run on Android.

That’s right. The operating system that so many of our phones run on is also used extensively in the POS terminal space. In fact, the global Android POS market is worth more than US$7 billion. The market for Android POS terminals is also expected to grow by around 30% by 2028. Given the platform’s flexibility, lower cost, security, and ability to integrate with third-party applications, that shouldn’t be surprising.

Android has evolved to fill a powerful niche in the POS terminal sector. And just as it’s evolved as an operating system (OS) on our phones and tablets, so Android will evolve as an OS on POS terminals. What does that future look like and how can businesses ensure that they’re on the right side of it?

Beyond the card and towards a revenue spinning platform

One of the biggest shifts we’ll see with the Android POS terminal is its ability to accept a growing array of payment methods beyond traditional credit and debit cards. In many African countries, for example, mobile money integrations, such as those provided by ExiPay in Zambia, will be critical. Digital wallets will also increasingly come to the fore.

POS terminals may soon evolve beyond simply being a way to accept payments for physical goods and services. Instead, they’ll become platforms that allow people to sell digital goods and services as well as physical ones.

Imagine, for instance, customers were able to buy a month or two’s subscription to their favourite streaming service while picking up some groceries, all paid for with their mobile money account.

If you go to the right stores, you don’t have to imagine it. Some of our customers have deployed terminals that offer digital goods and services and we are seeing an increasing level of interest in this type of opportunity.

These advances will help drive the shift towards POS terminals generating revenue rather than just acting as a payments device. The POS terminal providers that understand this will benefit from increased customer loyalty.

Another example of this is Android terminals driving the convergence of small business lending and payments. In the coming years, we’ll likely see lending businesses become payment facilitators, or establish partnerships with payment facilitators. So, for example, a micro-lender might allow people to apply for, receive, and pay back their loans at a small retailer, all through an Android POS terminal.

Changing the payment (and customer) experience

The evolution of Android in the payment terminal space also allows businesses to find ways to improve the payment and overall customer experience. Some retailers, for example, allow customers to pay for their goods on the shop floor, avoiding queues at the till. Others are even using their ecommerce stores on Android terminals to replace the traditional POS. In those instances, the physical retail location integrates seamlessly across stores and between physical and online stores. This concept is often referred to as endless aisle, since you can checkout goods across multiple locations and multiple sales channels.

The flexibility of the Android platform means that Android terminals are increasingly being used for unattended payments in places such as vending machines, parking lots, and for ticket purchases.

Android terminals can easily be repurposed to meet a variety of needs, with merchants able to be switched out in a matter of minutes. That’s potentially massive for small businesses or entrepreneurs just starting out who feel like they can’t justify buying a terminal outright. Instead, a terminal could be used by one merchant at a flea market on Friday, and a different merchant for receiving ticket payments at an event on a Saturday.

One of the interesting features of the Android screen is that it can display any information in relatively high resolution, and that includes QR codes that can be used for e-receipting. The Android terminal can display a QR code and consumer mobile phones can scan the QR codes to display the information contained in it. This includes following a link to retrieve a copy of their receipt, potentially making paper receipts obsolete for consumers with mobile phones. In addition, merchants can include additional information and loyalty offers which can be delivered via the receipt platform. This allows an Android terminal without a printer to deliver a rich receipt. Of course, where paper receipts are needed, then there is an Android terminal that can serve this purpose.

Embracing evolution

The evolution of Android POS terminals will result in significant changes in the way these terminals are used. Those changes bring opportunities for businesses to find new forms of revenue and to improve the overall customer experience. But that’s only possible if businesses embrace evolution and make full use of any new features on their terminals.

Most Read Articles

Have Your Say

What new tech or developments are you most anticipating this year?