MTN launches new mobile money solution MoMo

By Staff Writer 30 January 2020 | Categories: news

The frustration experienced by around 11 million South Africans who do not have access to financial services will now be a thing of the past, says MTN SA, with the launch the cellular provider’s mobile money service, known as MoMo.

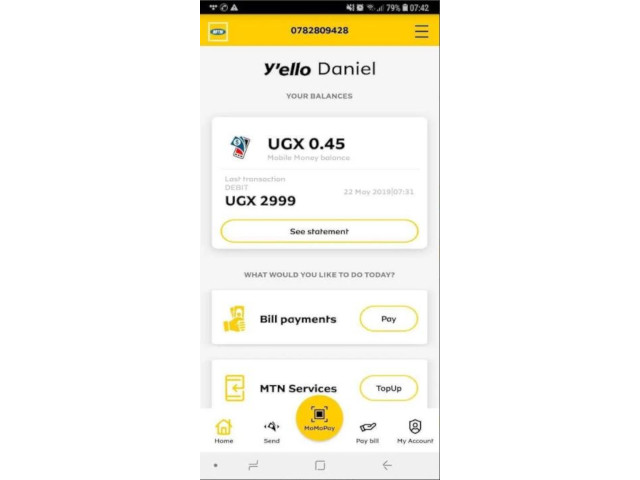

MoMo is available to all South African citizens, regardless of the network they are using. The platform, which is powered by UBank, enables customers to use their mobile phones, and other devices, to send and receive money, purchase airtime and prepaid electricity, and pay for their municipal bills and DSTV subscriptions. MTN notes this makes MoMo appealing to even the banked community who might not enjoy the burden of withdrawing cash from their accounts.

With regards to being able to use MoMo at retail stores, MTN is taking a phased approach in terms of bringing the full offering to life. Adding South Africa’s well-known retail brands to the platform will be implemented from May 2020 onwards.

MoMo is available to customers who use both smartphones, and basic feature phones, making it a solution that can be used by anyone.

MTN MoMo offers two types of accounts, a Yello account and a Yello Plus account. On the Yello account, daily cash transactions are limited to R3 500. The total daily amount for a full range of transactions is R10 000, while the monthly account limit is capped at R20 000. On Yello Plus, daily cash transactions are limited to R10 000. The total daily amount for a full range of transactions is R20 000, while the monthly account limit is capped at R40 000.

MoMo customers can cash in funds at MTN-branded stores, at UBank branches, or through their own banks via electronic funds transfers (EFTs). Similarly, they can use these options to cash out funds.

Customers have three options to register for MoMo. They can either self-register via USSD by dialling *120*151# and follow the voice prompts, or they can download the free MoMo app on the Google Play Store and self-register. The third option is for customers to register directly with a MoMo agent at any MTN-branded store.

MTN is awaiting final approval from Apple to register the MoMo app on the Apple App Store. This is expected to be finalised within the next couple of weeks.

As is the case with any new fintech solution, customers are always concerned about security. Felix Kamenga, Chief Officer of MTN SA Mobile Financial Services, says that providing customers with peace of mind and the confidence that they can transact safely was a top priority when designing the MoMo platform.

“The beauty of MoMo is that we have struck a balance between building world-class safety and security measures without compromising the ease of use and simplicity of the platform,” says Kamenga.

MoMo uses biometrics like voice and facial recognition to authenticate users. The details of MoMo customers are cross-checked with the population database at the Department of Home Affairs. In addition to this, the user’s funds are also protected by a PIN. If the MoMo customer loses their phone, their money is still safe.

MoMo use the Ericsson Wallet Platform, providing MTN with a flexible, reliable and efficient m-commerce solution, systems integration, operational support and solution development.

“Another very important part of this journey for us was to ensure that we contribute positively towards enabling job creation,” says Kamenga. “MoMo currently has about 50 dedicated agents that are based at selected MTN-branded stores, and we continue to recruit. We expect to have around 400 agents in all stores by the beginning of the second quarter of this year.”

In addition to store-based agents, MoMo will have non store-based agents that will help to facilitate registrations and cash-in’s and cash-out transactions across the country. Agents are carefully vetted and receive extensive training to ensure that they are able to deliver exceptional service to MoMo customers.

“We believe this will go a long way towards alleviating the challenge of unemployment,” says Kamenga.

MTN also has plans to bring other value-added services to MoMo customers.

“We look forward to bring a range of other services to MoMo customers in the near future including loyalty rewards, a savings account, and loans. We are on a continued journey to bridge the digital divide, because we believe that everyone deserves the benefits of a modern, connected life,” concludes Kamenga.

Most Read Articles

Have Your Say

What new tech or developments are you most anticipating this year?