Q&A, Mark Bradshaw, SNAPnSAVE

By Robin-Leigh Chetty 22 July 2015 | Categories: interviews

For any consumer, whether it be the newly employed graduate, or mother of a family of five, the cost of groceries remains a primary concern. As such, the ability to save money where one can is highly advantageous. To that end, new digital couponing app SNAPnSAVE made its official debut earlier in the month, in an effort to not only help consumers, but also give brands a unique avenue for creating awareness.

TechSmart had a chat with SNAPnSAVE CEO, Mark Bradshaw, to discuss how the app came into being, the opportunities resulting from digital coupons, and more.

.jpg)

TS: Can you expand on the inspiration behind the development of SNAPnSAVE, was there a clear gap in the market that needed to be addressed?

MB: We’ve seen this concept work well in the US and parts of Europe, and currently there isn’t a solution like this in SA.

From a consumer perspective, helping people save money on things they need is always going to be very relevant in tough economic times like these. The challenge in South Africa is about making saving discrete, and that's why coupons have never taken off here.

Brands are continuously looking for ways to reach the right audience at the right time. This platform provides a place where brands can engage with shoppers when they’re looking to shop.

TS: SNAPnSAVE cites the "coupon trend" as a major retail influencer in years to come. Having seen significant growth in the US in particular, why do you think it can have an effect locally?

MB: South Africa is far behind the trend in terms of coupons. We believe this is partly due to barriers around traditional paper coupons, and also due to South Africans’ attitude towards saving.

Saving or being savvy with your money is something that people boast about in more developed parts of the world. In SA, we tend to be too proud to admit that we saved some bucks.

The reality is that we all like having more to spend on the things we want. We have looked at making the process of getting cash back off purchases convenient and something that you can do in discretely or in the privacy of your own home.

.jpg)

TS: SNAPnSAVE was developed with the help of TAT Ventures, can you tell us how this partnership came about, and how big a role they have played?

MB: TAT Ventures is an overseas-based investment house that back start-up tech ideas that develop African solutions to African problems.

I have been involved in the mobile couponing space for a number of years now. Through my various connections, I was put into contact with TAT Ventures who were looking to Africa as an opportunity to rollout some their existing e-commerce platforms. When they saw the gap in the coupon market here in SA, they moved quickly and SNAPnSAVE was born.

TS: As far as local brands go, how can they benefit from the service that SNAPnSAVE offers?

MB: We believe that SNAPnSAVE provides brands with an effective marketing platform to engage with shoppers.

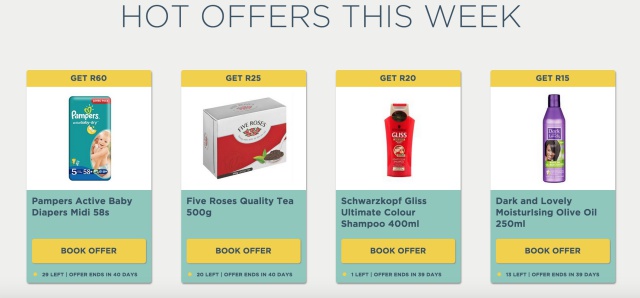

SNAPnSAVE drives measurable sales along with relevant impressions. Our offers allow shoppers to discover and try new products, and can also be used to reward customers for their loyalty or engagement.

TS: From the consumer side, which local retailers will be working in conjunction with SNAPnSAVE?

MB: You can buy items for booked offers at any retailer across the country. It is the brands that determine if they want to limit where a user can buy an item for a booked offer.

TS: In terms of the SNAPnSAVE e-wallet, how do consumers go about obtaining the cash they've saved?

MB: We’ve integrated with wigroup, which allows us to give users a code that they can then use when shopping at specified retailers.

Over time, we will be looking to give other options in terms of spending cash back. For example, we want to enable users to spend their cash back to buy airtime or electricity.

TS: It's still very early in terms of SNAPnSAVE's official rollout, but what has the consumer engagement been like to date?

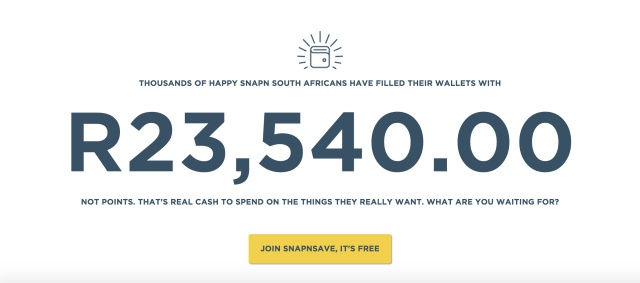

MB: Considering that we have only just launched and have yet to start our main advertising activity, the response has been really good so far. In the last 15 days, we have already handed back thousands of rands in cash back to new users.

We estimate that users can expect to get up to R450 in cash back every month if they use the service regularly.

TS: Looking forward, are there any developments that SNAPnSAVE is working on, that you're able to mention at this stage?

MB: We have lots of ideas on additional features that could add to the SNAPnSAVE experience. Right now, the focus is to make sure that the basic service runs smoothly. A good user experience is vitally important to us and we want to make sure we get that right before complicating things further. We have some exciting developments planned for later this year but you will need to keep an eye out for more news on that.

Most Read Articles

Have Your Say

What new tech or developments are you most anticipating this year?